nj bait tax example

Good News in New Jersey. 10 Californias top individual tax rate is 133 consisting of 123 of regular tax and an additional 1 for.

New Jersey Archives Page 2 Of 6 Alloy Silverstein

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local.

. Bracket Changes As a result of the amendments the BAIT increases to the. For S-corporations BAIT is calculated on NJ source income from the K-1. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT.

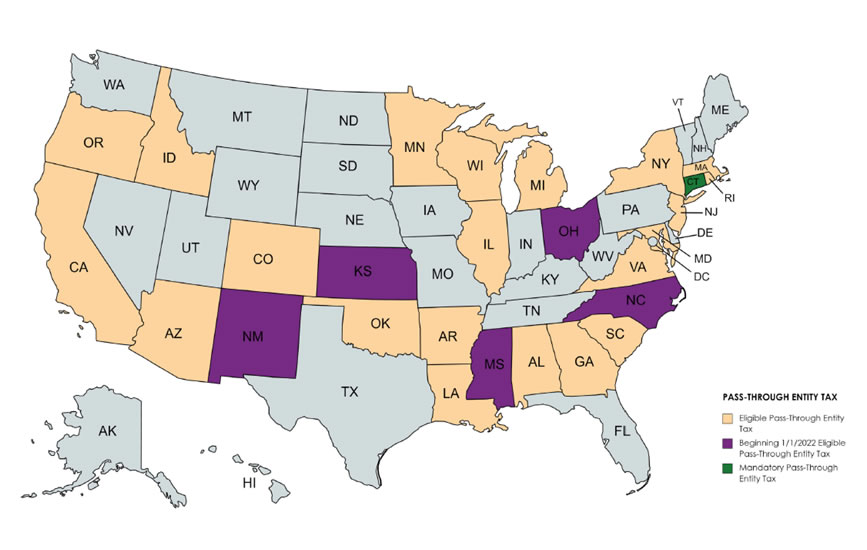

The BAIT is imposed at the following rates based on the collective sum of all the PTEs members shares of distributive proceeds for the tax year. Signed into law in January the BAIT is a new. NJ BAIT Apportionment Factor For tax year 2021 S Corporations will have the option of using the single sales factor or the three-factor formula Sales Payroll Property to.

The New Jersey elective pass-through entity PTE tax known as the Business Alternative Income Tax or NJ BAIT became effective for tax years. The BAIT for New Jersey S Corporations continues to be limited to New Jersey-sourced income. The entity must have at least one member who is liable for tax on their share of distributive proceeds pursuant to the New Jersey Gross Income Tax Act NJSA.

New Jersey joined the SALT workaround bandwagon this year by establishing its Business Alternative Income Tax BAIT. Using the graduated tax schedule tax on 900000 would be 5656750. In January 2020 New Jersey enacted the Pass-Through Business Alternative Income Tax BAIT.

A partnership with a fiscal year of 1012193022 will file a 2021 PTE-100. Were going to take a deduction for the New Jersey BAIT paid in 1581750. This legislation generated only passing interest from the taxpaying.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local. The concerns of passthrough. The highest tax bracket now kicks in at 1000000 to be more in line with individual tax rates.

What is the NJ BAIT. However as t he BAIT enables owners of PTEs to reduce their federal taxable income by remitting this. The tax rates for NJ BAIT range from 5675 to as high as 109 on New Jersey sourced income.

In Californias initial PTE tax proposal no tax rate was listed. Business Alternative Income Tax BAIT Now ImprovedTaxpayer concerns result in modification of prior law. If the sum of each members.

The NJ BAIT tax payment is made by SCorp after registering at NJ Pass Thru BAIT. Tax is imposed on the sum of each members share of distributive proceeds which is 900000. The purpose of this guidance is to provide answers and clarification to commonly asked questions regarding PL2019 c320 C54A12-1 et al and PL.

5 Ways To Calculate Income Tax In Canada

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis

Form Nj 1040nr Fillable Non Resident Income Tax Return

Nj Salt Work Around Pass Through Entity Tax

When Should I Make My 2022 Ptet Election Berdon Llp

New Jersey Sweetens Pot In Bid To Become American Capital Of Offshore Wind Recharge

Explainer Decoding Nj S Budget Babble A Dictionary Of Useful Terms Nj Spotlight News

New Jersey Pass Through Business Alternative Income Tax Act Bait L H Frishkoff Company

What Is The W 9 Tax Form And How Do You Fill It Out

New Jersey Partnership Tax Login

The New Jersey Business Alternative Income Tax Nj Bait What You Need To Know Rosenberg Chesnov

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

2018 New Jersey Payroll Tax Rates Abacus Payroll

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

What Is New Jersey Business Alternative Income Tax Nj Bait Tax Tax Tips With Ajay Kumar Cpa Youtube

Historical New Jersey Tax Policy Information Ballotpedia

Nj Division Of Taxation Nj 1040 And Nj 1041 E File Mandate Faq